Rebound in Trade: India’s Iron Ore Exports to China Witness a Dramatic Rise

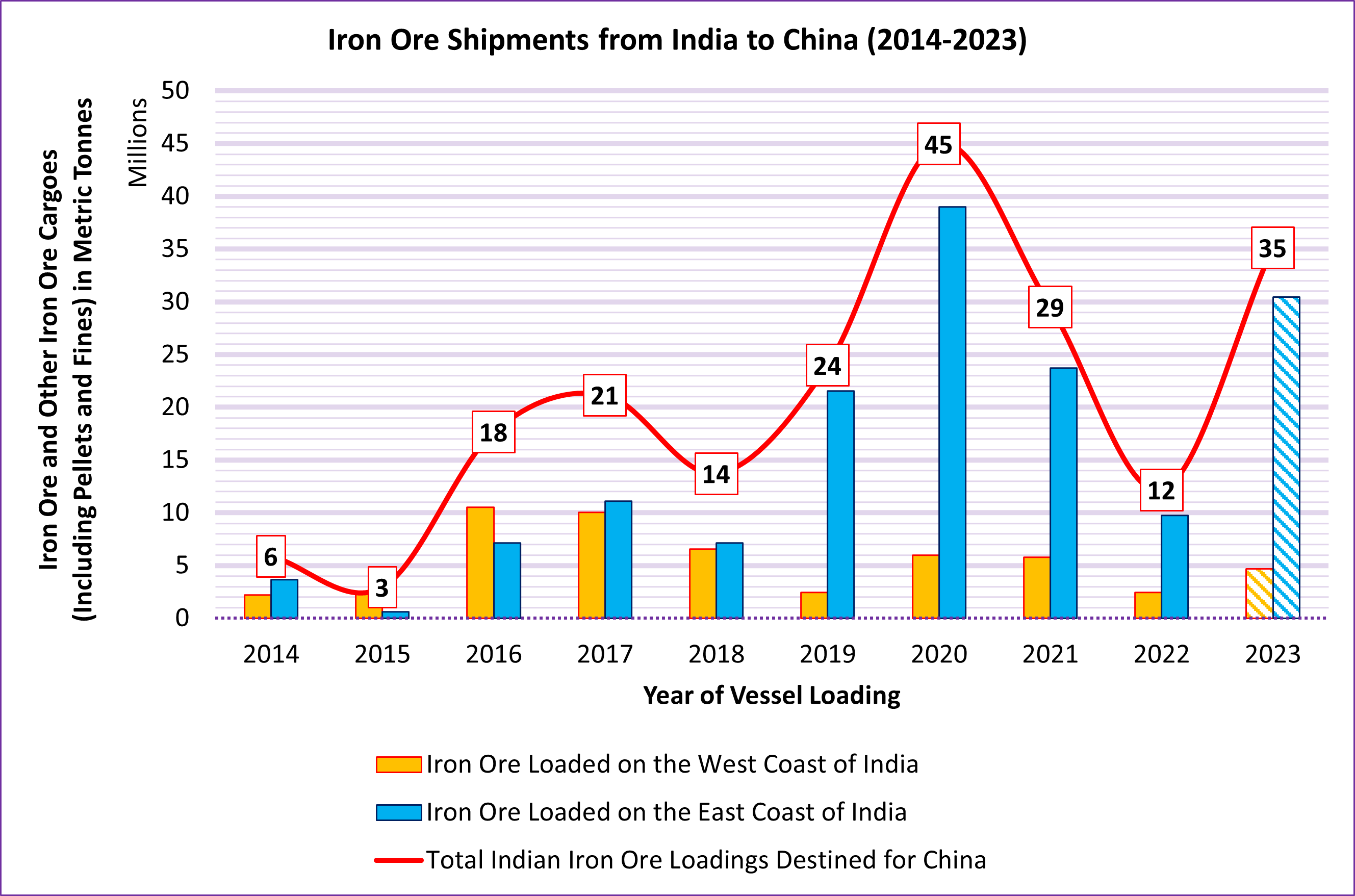

Today, we explore the historical vessel movement data from AXSMarine, illustrating the annual Indian bulk seaborne iron ore exports to China from 2014 to 2023. This analysis includes all forms of iron ore such as magnetite, pellets, fines, lump ore, concentrates, and sinter cargoes transported by dry bulk carriers from Indian ports to China. Our chart differentiates between exports originating from West Coast India and East Coast India, highlighting that trade from the East Coast to China is more significant in volume, as shown in the chart.

Preliminary data for 2023 indicates that Indian iron ore exports to China have reached 35.12 million metric tonnes so far, with 4.66 million metric tonnes loaded in West Coast India and 30.46 million in East Coast India.

Notably, data from 2023 suggests that Indian bulk seaborne iron ore exports to China have increased by 188% compared to 2022. The significant drop in exports over 2021 and 2022 can be attributed to various factors, including the Indian government’s high export duties. In May 2022, India raised the export duty on all iron ores to 50% and on iron ore pellets to 45% to address domestic demand. This policy significantly reduced exports. However, after approximately six months, India revised these duties, removing the tariff on low-grade iron ore and related products to mitigate domestic oversupply. The duty on iron ore lumps and fines with less than 58% iron content was abolished, and the rate for higher-grade iron was reduced to 30% from 50%.